A Call for Synthetics Transparency

Published: 22nd July 2021

This article was originally published by Rapaport. Click here to see the original article.

Among the challenges of assessing the lab-grown diamond market is the lack of published data on the sector. That’s largely because none of the companies operating in the space are publicly traded, which would require them to disclose metrics such as sales, profit and production.

It’s largely through public reports by miners such as Alrosa, De Beers (via Anglo American), Petra Diamonds and others that one can gauge the size of the natural-diamond market. Their reports also provide important anecdotal information about trends and the state of the market. The same is true for the retail sector, with Signet Jewelers serving as a bellwether for US jewelry sales, Chow Tai Fook in Hong Kong and China, and the likes of Richemont and LVMH reflecting the state of high-end jewelry.

In addition, regular import and export data from governments in major diamond centers such as Belgium, India and the US provide insights about the global trade.

Very little of that exists in the synthetics market. Only India has separate Harmonized System (HS) codes — the identifiers that authorities use for imported and exported goods — for lab-grown and natural diamonds, enabling it to distinguish between the two in its trade data. The US and other countries currently lump the two products into one category.

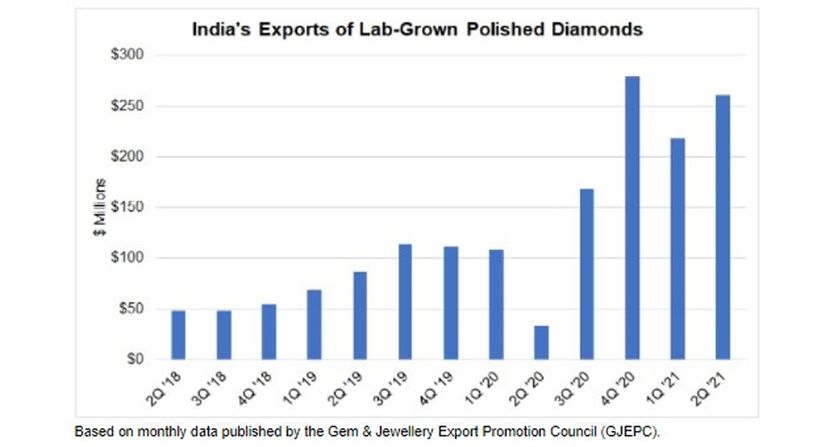

The Indian figures show a sharp rise in synthetics exports this year (see graph), but it’s difficult to draw conclusions from one metric alone.

There is also a distinct lack of structure in the lab-grown market. While there have been initiatives to create organizations that represent the sector, set policy, and lobby on its behalf, they have not gained traction. Such an organization would also create a directory of companies operating in the market. Some growers such as WD Lab Grown Diamonds and Diamond Foundry are emerging as majors that set the tone on certain issues. Yet at present, there is a cloud over who the major suppliers, manufacturers and sellers of lab-grown are and how the supply chain operates.

Such efforts would go a long way toward bringing some much-needed transparency to the synthetics market — and might also lead to warmer relations with its natural-diamond counterpart.

That’s why it’s important to understand if the product you are selling is natural. No consumers should get caught out in selling undisclosed synthetic/lab grown diamonds.

Avi Krawitz

22 July 2021

Diamond Verification Services is a completely independent organisation owned by Sheffield Assay Office. Offering state of the art technology we help our customers buy and sell diamond products with complete confidence, and provide a quick and easy process to confirm a diamond's true origin. For more information about how Diamond Verification Services can help you as a retailer or purchaser, please contact us on email at info@diamondverificationservices.co.uk or call +44 (0)114 2312121.

The Sheffield Assay Office was established in 1773, under an Act of Parliament and today the company assays and hallmarks the precious metals - silver, gold, platinum and palladium. Sheffield Assay Office is one of only four UK assay offices who all work to uphold the Hallmarking Act of 1973 and continue to ensure consumer protection for customers purchasing precious metals.

To find out more about the whole range of services offered by Sheffield Assay Office, such as our hallmarking and analytical services, please email us at info@assayoffice.co.uk or complete the contact form on our website at http://www.assayoffice.co.uk/contact-us ,

Sign up here to all the latest news from Sheffield Assay Office direct to your inbox